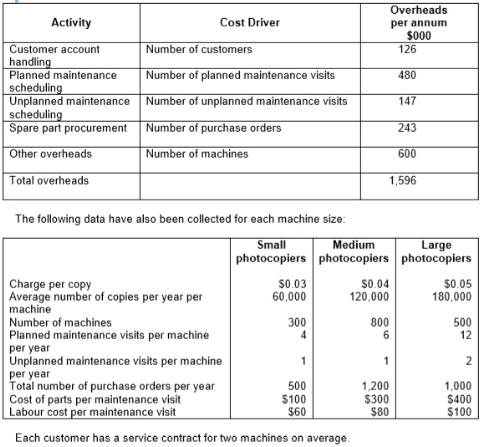

A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

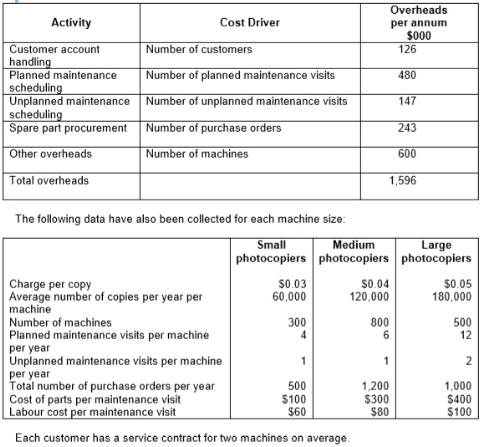

The company's existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department's support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company's accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine, using the current basis for charging the costs of support activities to machines.

Show Answer

Hide Answer