Theresa Ponder and Rod Owens are analysts for a multinational investment bank, Datko Bank, based in Canada. Datko's clients have been advised to diversify globally, due to a decrease in expected long-term growth for North American economies.

As part of her analysis of global stocks, Ponder uses the domestic CAPM and the international CAPM to value stocks. She makes the following statements regarding the extension of the domestic capital asset pricing model (CAPM);

Statement 1: To extend the domestic CAPM to international asset pricing using the extended CAPM, one must make two additional assumptions. First, that global investors have identical consumption baskets and second, that interest rate parity holds throughout the world.

Statement 2: The extended CAPM assumes that exchange rate changes are predictable so that there is no real exchange rate risk.

As the primary analyst for European securities, Owens analyzes the stocks in the countries of Catonia and Arbutia. Catonia and Arbutia arc not currently members of the European Union, but have a timetable for joining by the end of the decade.

To evaluate Caionian stocks, he uses the international CAPM. Owens mentions that a foreign currency risk premium must be added in this model, and that the risk premium depends on various parity conditions. He finds that the foreign exchange expectation relation and interest rate parity hold between Canada and Catonia. The interest rate in Canada is 2%, and the interest rate in Catonia is 5%.

One of the companies Owens follows in Arbutia is Diversified Metal Finishers. Diversified produces customized sheet metal applications for manufacturers throughout the world. The firm enjoys a competitive advantage because Arbutia is a commodity-rich country which allows Diversified to source its inputs locally. Owens has found that when the Arbutian currency changes by 10%, the value of the Diversified stock generally changes by 6%.

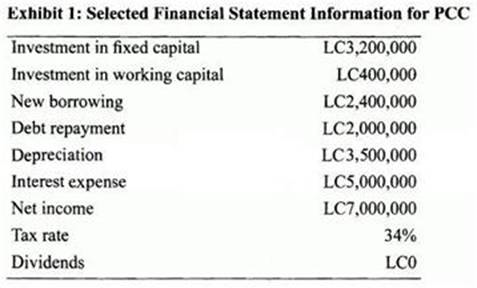

Ponder is also analyzing stocks in the nations of Bisharov and Dineva. She is estimating the expected return using the international CAPM (ICAPM) for Ivanova Metals, located in Dineva. The data for Canada, Dineva, and lvanova are shown in the following. The foreign currency is denoted as the local currency (LC).

Canadian risk-free rate 2.00%

Dineva risk-free rate 8.00%

World market risk premium 6.00%

Dineva index beta to world market index 1.40

Dineva local market risk premium 7.50%

Ivanova beta to local index 1.30

Foreign currency risk premium 3.00%

Dineva sensitivity of LC stock returns to LC 0.70

Owens examines Ponder's analysis and makes the following statements:

Statement 1: To protect the growing economy and prevent capital flight, the Bisharov government taxes foreign investors at higher rates and has placed limits on currency convertibility. In Dineva, the government has taken a more hands-off approach and does not regulate .foreign investment. If the world were to consist entirely of countries like Bisharov, then the ICAPM cannot be applied.

Statement 2; Furthermore, inflation is often a concern in emerging market countries. To measure an exchange rate between Canada and an emerging market currency that is adjusted for inflation, a real exchange rate should be calculated. Assuming no change in the real exchange rate, the change in an emerging market's asset values in domestic currency will just reflect the emerging market's asset returns in local currency and the difference between inflation rates in the domestic and foreign countries.

What is the expected return using the ICAPM for Ivanova in Ponder's analysis?

Show Answer

Hide Answer

Correct Answer:

B

The ICAPM states that the expected return on any asset is equal to the investors domestic risk-free rate, plus a world market risk premium times the asset's world market beta, plus a foreign currency risk premium times the sensitivity of the asset's domestic currency return to a change in the local currency. AH returns are measured in domestic currency. Note that the foreign risk-free rate and local market risk premium are not used.

Given the sensitivity of LC stock returns to the LC of 0.70, we need to convert this to the sensitivity of the asset's domestic currency returns to the local currency. Using the formula for the sensitivity of the asset's domestic currency return to a change in the local currency:

(Study Session 18, LOS 66.j)