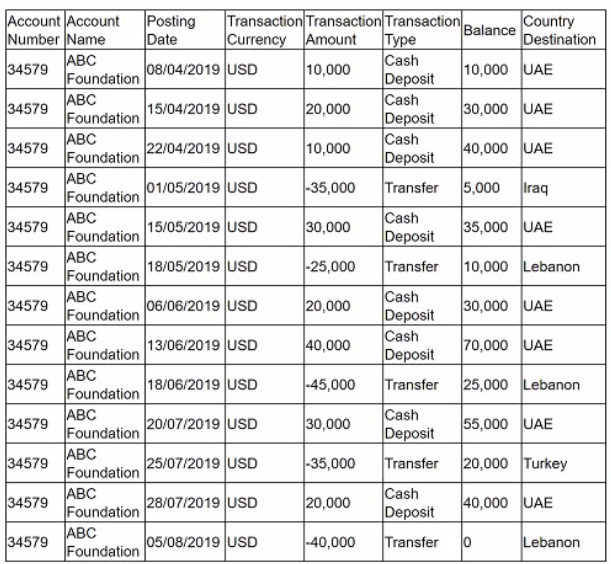

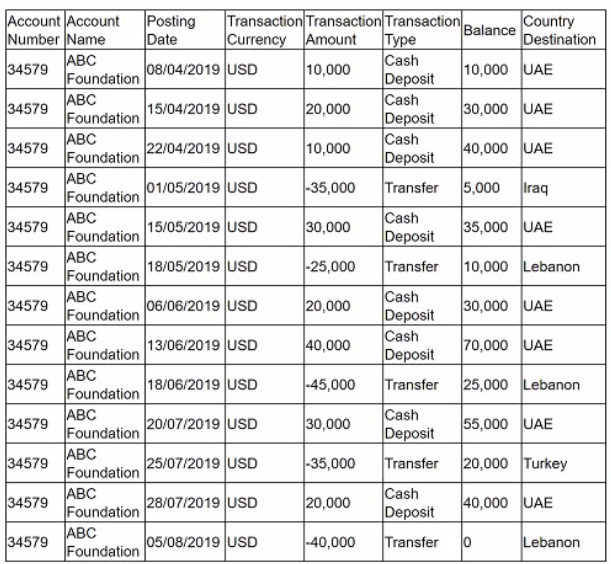

Each month the automated transaction monitoring system generates alerts based on predetermined scenarios. An alert was generated in relation to the account activity of ABC Foundation. Below is the transaction history for ABC Foundation (dates are in DD/MM/YYYY format).

The relationship manager for ABC Foundation contacts the client to request more information on the beneficiary of the transfer in Turkey. ABC Foundation advises that this is a not-for-profit charity group called 'Forever Free." Which is the best next step in the investigation?

Show Answer

Hide Answer

Correct Answer:

C

The best next step in the investigation is to check the jurisdiction's list of known charities with connections to terrorist activity . This is because the FI has a responsibility to verify the legitimacy and reputation of the beneficiary of the funds, especially if it is a charity or non-profit organization that operates in a high-risk jurisdiction or sector. According to the ACAMS Advanced Financial Crimes Investigations Certification Study Guide1, ''the FI should conduct enhanced due diligence on all parties involved in the investigation, including checking various sources of information, such as watch lists, sanctions lists, negative news, and official registries'' (p. 24). The FI should also check if the beneficiary is consistent with the customer's profile and expected activity.

The other options are not as appropriate or effective as option C. Contacting the financial institution in Turkey that has a relationship with Forever Free and advising them of the investigation (A) could violate confidentiality or data protection laws, as well as compromise the investigation or alert the customer or beneficiary of the suspicion. Updating the customer profile to include Forever Free as the recipient of the funds (B) could be premature or inaccurate, as it does not verify the nature and purpose of the transfer or the identity and legitimacy of the beneficiary. Filing a SAR/STR with the new information learned about the beneficiary (D) could also be premature or incomplete, as it does not confirm if there is any suspicious or criminal activity involved in the transfer or if there are any other red flags or indicators.